Explain the Difference Between a Cost and Expense

Answer 1 of 6. Companies incur and record costs in running the day-to-day operations of the business.

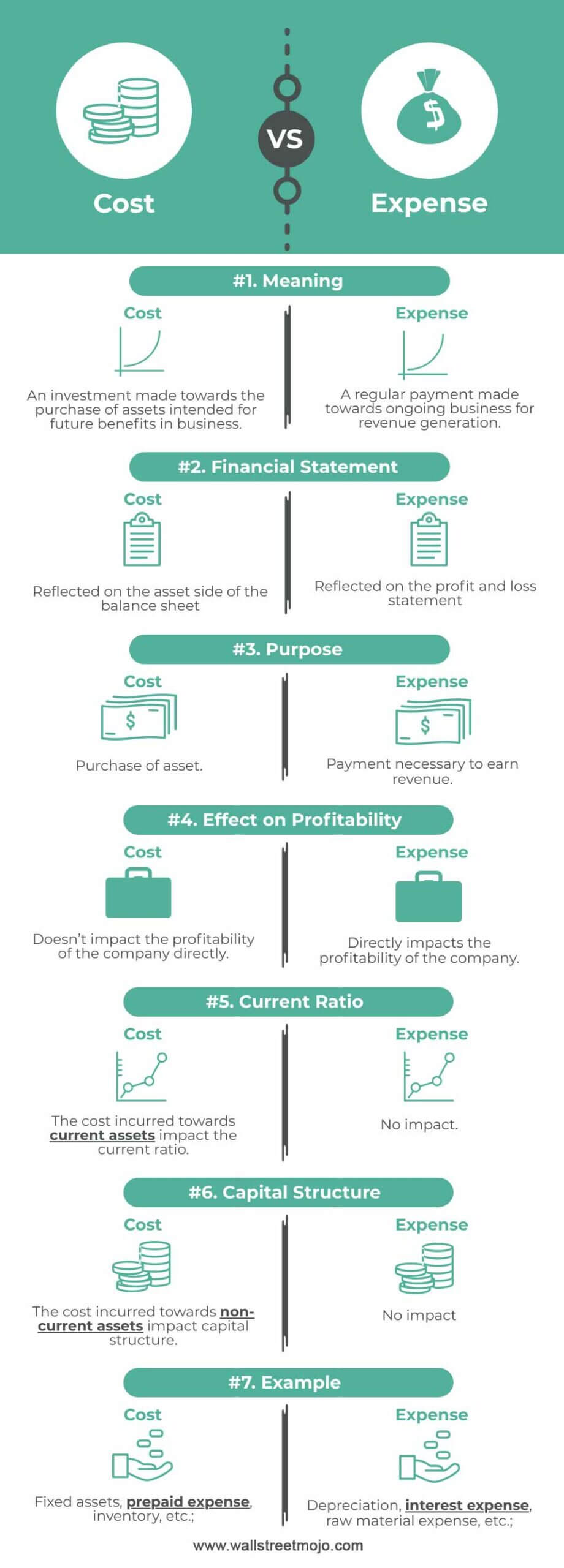

Cost Vs Expense Top 7 Best Differences With Infographics

A cost might be an expense or it might be an asset.

. You can use accounting costs when determining your total expenses and comparing this to your overall gross profit. Income statement is prepared by debiting expenses and crediting revenues for a per. A cost incurred can be either an asset or an expense or both depending on the timing of accounting transactions.

Cash payment of currency for eg. When the company buys the machines the price Penway pays or promises to pay is a cost. Operating expenses are also known and SGAsales general and administrative expenses.

Solution for Explain the difference between a direct cost and an indirect cost. To which class does cost belong. Whereas if we capitalize on the cost then it means that we have accounted for it as an asset on the balance sheet with only depreciation showing up on the income statement.

Difference Between Cost and Expense The key difference between Cost and Expense is that cost refers to the amount spent by the business organization for the purpose of acquiring an asset or for creation of the assets whereas the expense refers to the amount spent by the business organization for the ongoing operations of the business in order to ensure the generation of the. The company has already paid for the expense. These costs are separated into two categoriesCost of Sales and Operating Expenses.

If we expense a cost then it is included in the income statement by subtracting it from the revenue and determining profit. Expired cost is the cost that has been already incurred while deferred cost is one which. Expenses may occur in the following forms.

Whats the difference between a cost and an expense in accounting. The cost of producing a. Start your trial now.

An expense is a cost that is expired and is incurred to the company ie. Cost of sales may also be called cost of services and cost of goods sold. Cost is used for buying assets while expense is used when buying liabilities.

An expense is a cost that has expired or was necessary in order to earn revenues. The cost incurred as expense usually expires during the same accounting period ie. While cost includes both expired and deferred cost.

It is not carried forward to a future period. A companys property insurance bill. Cost is reported in the balance sheet because it means more funds will come to the balance sheet after the expenditure.

To address your que. An expense is a cost of money but one in which you know will further decrease your revenue and income. Money youll spend on loan payments is entered as Financing in LivePlan.

While accounting costs measure the monetary value of an action like payroll or utilities an economic cost considers the potential difference between one action versus another. Cost is typically the expense incurred for making a product or service that is sold by a company. Some people use cost interchangeably with expense.

However we use the term cost to mean the amount spent to purchase an item a service etc. Whereas expenditure refers to the long-term costs incurred by the company for its establishment and operations. So the resources Penway uses to purchase the machines move from the balance sheet cost to the income statement expense.

It is a set of procedure which is followed in order to prepare the statement of cost and income. Several steps need to be followed in a sequential order to achieve the objective of providing the information related to cost of products and services. The cost was the amount of money it cost to purchase expense is the difference between the cost of the product sold and the cost of the product produced.

May 25 2017. In accounting though all three words that is cost expense and loss represents outflow of funds from the company to outside world however there is a difference in the manner in which the outflow of funds or cash happens. Income statement accounts are classified into revenues expenses gains and losses.

On the other hand expenses are the cost of resources consumed in the operations of a business during an accounting period. This includes things like rent utilities marketing office supplies and so on. Expense refers to short-term costs incurred by the company.

Incurred expense refer to the entire expense invested in making the product which includes the expense that could not be cost and less than the product which is greater than the materials is work in progress. Cost can be classified as part of EITHER expenses or losses. The main difference between expenses and losses is that expenses are incurred in order to generate revenues while losses are related to essentially any other activity.

Both the terms are valuable in the accounting equation since both have specific contributions and meanings. Price is the amount a customer is willing to pay for a product or service. A common term used in accounting and businesses along with expenditure and cost an expense is also money spent.

For example if you own your business you will have to pay your employees. The difference between cost and expense is that cost identifies an expenditure while expense refers to the consumption of the item acquired. Example of a Cost.

A key reason why a cost is in practice frequently treated exactly as an expense is. Paying bills such as rent salaries etc. Cost is used on something that has returns while expenses are expenditures used on things that depreciate.

Also the expense was necessary for the company to earn revenues. Basically an expense is money you spend in day-to-day business activities that arent direct costs. For example the cost of serving meals is an expense of a restaurant.

Some costs are not expenses cost of land some costs will become expenses cost of a new delivery van and some costs become expenses immediately airing a televison advertisement. What is the difference between cost and expense. Then as Penway uses the machines it reclassifies the cost of buying the fabrication machines as an expense of doing business.

Expense Money spent by a firm for generating revenue is termed as expenditure or expenses. April 05 2022 Steven Bragg. Unlike assets expenses do not provide a definite value to a business beyond the accounting period in which they are incurred.

Another difference is that expenses are incurred much more frequently than losses and in much more transactional volume. First week only 499. Money youll spend on inventory is entered as Inventory.

These terms are frequently intermingled which makes the difference difficult to understand for those people training to be accountants.

Cost Vs Expense Power Point Template Presentation Design Template Pinterest Success

Cost Vs Expense Top 7 Best Differences With Infographics

Difference Between Cost And Expense Accounting Principles Cost Expensive

No comments for "Explain the Difference Between a Cost and Expense"

Post a Comment